When you consider the tools that help your nonprofit maximize its impact, what comes to mind? You probably think about your fundraising software, strategic plan, materials for delivering

services, or even your staff’s energy and passion for your cause. What you might not think of right away are your organization’s financial management resources, although they’re just as critical for furthering your mission as any of the other tools we’ve mentioned.

One essential process for managing your nonprofit’s finances is budgeting. While you might generally know what a budget is—a document that lays out your organization’s projected spending and revenue generation—a lot more goes into successful nonprofit financial planning than just writing down those numbers once a year.

In this guide, we’ll share three tips to improve your nonprofit’s budgeting process so you can maximize these resources’ effect on your community impact. Let’s get started!

1. Understand the Different Types of Nonprofit Budgets

Your nonprofit’s team completes a wide variety of tasks every day. Some employees spend their workdays running your programs, while other staff members are planning your annual gala, seeking out grant opportunities, or analyzing data from your last capital campaign. Every one of these activities is vital to your organization’s impact—and every one needs its own budget to ensure funds are used effectively to accomplish it.

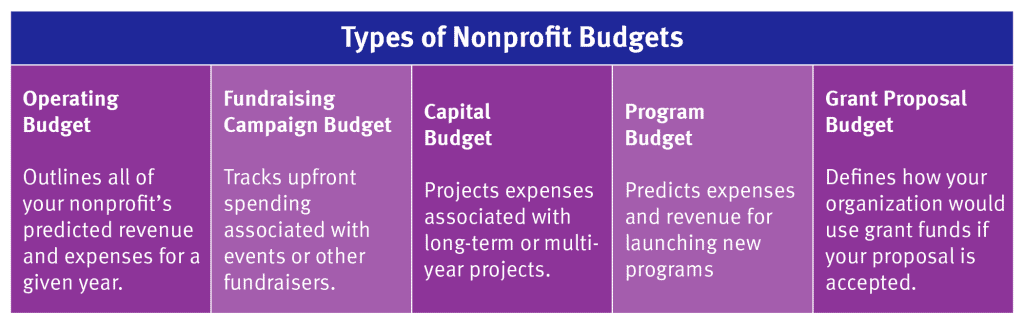

Jitasa’s nonprofit budgeting guide explains the major types of nonprofit budgets as follows:

- Operating budget: This is the master financial plan that probably comes to mind when you hear the word “budget.” It lays out all of your organization’s predicted revenue and expenses for a full fiscal year, and every other budget you create should align with it.

- Fundraising campaign budget: These budgets track the upfront costs associated with revenue-generating initiatives, especially highly involved fundraisers like events or 24-hour giving days, and help you ensure a positive return on investment (ROI).

- Capital budget: Multi-year initiatives like capital campaigns also need their own budgets to track upfront spending and map out costs at each stage of the campaign.

- Program budget: When you launch a new mission-related program, it’s often helpful to create a separate budget so you can differentiate one-time startup costs from recurring expenses for that program.

- Grant proposal budget. Most grantmakers will ask your nonprofit to submit a budget detailing how you plan to use the funding along with your proposal so they know you’ll manage the grant effectively if they award it to you.

Your nonprofit’s financial team (chief financial officer, accountant, treasurer, etc.) will take the lead on creating all of these budgets, but other staff members should have input on each one for them to be effective. For example, your fundraising team needs to consult on your campaign budgets to help strike a balance between saving money and creating a memorable experience for donors.

2. Set SMART Budgeting Goals

As NXUnite’s guide to starting a fundraiser explains, clear goals lay the foundation for a successful planning process. The best way to set an actionable goal is to follow the SMART framework: specific, measurable, attainable, relevant, and time-bound. Financial planning is no different—SMART goals make your budgets more useful for maximizing your resources.

Here is an overview of how to apply the SMART framework to budgeting:

- Specific: Clearly define all of your revenue and expenses using general categories and more granular subcategories. For example, instead of just dedicating a chunk of funding to “Marketing” on the expense side of a fundraising campaign budget, break down that category by channel (email, social media, flyers, direct mail, etc.).

- Measurable: This one is pretty straightforward—include a dollar amount for every line item on both sides of your budget, and add lines for category and overall totals. This way, you can evaluate your success by comparing your budgeted and actual numbers and have a clear reference for creating future budgets.

- Attainable: Reviewing past budgets is helpful for setting future spending and fundraising goals that push your team to work hard to further your mission while saving money, but are still realistic in the context of your nonprofit’s current financial situation. If revenue goals are too far out of reach, they may demotivate your team, and cutting too many costs can sacrifice your programs’ and fundraisers’ quality.

- Relevant: Compare your budgets to other key documents like your nonprofit’s strategic plan, grant proposals, and capital campaign timelines to ensure your projected revenue and expenses will contribute to your organization’s overall goals.

- Time-bound: Consider not only the full time frame of your budget, but also when specific expenditures and acquisitions of funds will occur. For instance, note in your operating budget that individual donations to your nonprofit typically peak during the year-end giving season and die down in the summer.

Different staff members will likely have their own opinions about what budgetary goals are actually SMART for your nonprofit, which is why it’s important for multiple teams to share their perspectives and come to a consensus on spending and revenue generation priorities.

3. Organize Your Budgets Logically

All nonprofit budgets have two sides—revenue and expenses—but aside from that, their structure depends on their purpose. Although your finance team will have the final say on categorization to ensure alignment with your internal records and nonprofit reporting requirements, it’s helpful to have a general understanding of how your budgets are organized for easy reference.

Let’s take operating budgets as an example because they touch every aspect of your nonprofit’s activities. The revenue side of these budgets is usually organized by source to help your organization develop a stable, diversified funding model. Here are some examples of categories and subcategories your financial professionals may use:

- Individual donations: Small, mid-sized, major, and planned monetary gifts; event revenue; in-kind contributions of goods, services, and assets (stocks, real estate, etc.)

- Corporate philanthropy: Sponsorships, matching gifts, volunteer grants, internal employee fundraising campaigns

- Earned income: Membership dues, merchandise sales, service fees

- Investments: Endowment fund interest, treasury bills, bonds, mutual funds

- Grants: Federal and state government grants; public, private, and family foundation grants

The expense side of your operating budget will typically be divided between program costs—i.e., any expenditures that directly further your mission—and overhead. Overhead is further split into fundraising costs (e.g., event planning, marketing, software subscriptions, and consulting fees) and administrative costs (e.g., staff compensation, utility bills, insurance, and office equipment purchases). This division, known as functional expense categorization, matches IRS Form 990 to ensure consistency among financial documents.

While the tips above will help your nonprofit create better budgets, you should also know that effective budgeting isn’t a set-it-and-forget-it activity. Instead, your financial team and any staff members who had input on each budget should periodically review it and make adjustments as needed to ensure you’re making the most of your organization’s funds for your mission.